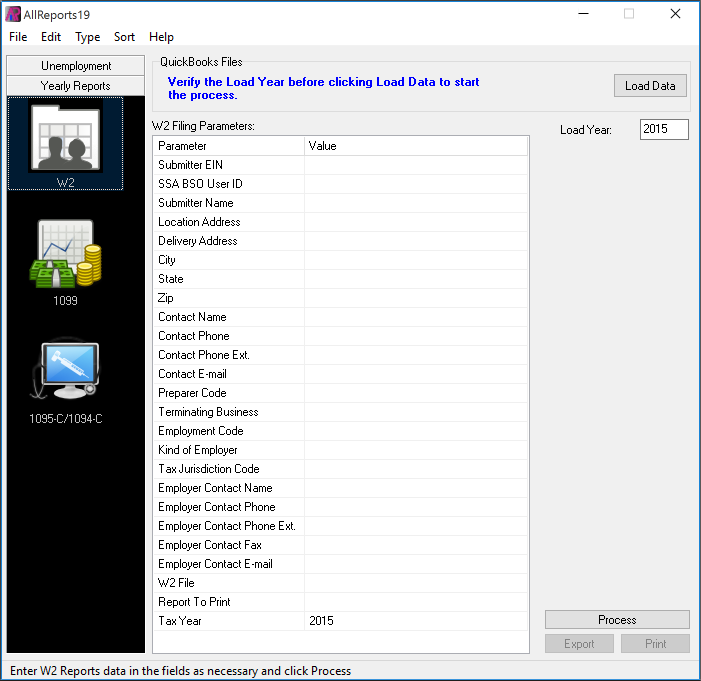

We have released AllReports 29! It includes all the updates for filing and printing your 2025 W2 and 1099 reports! Download it today and happy tax season!

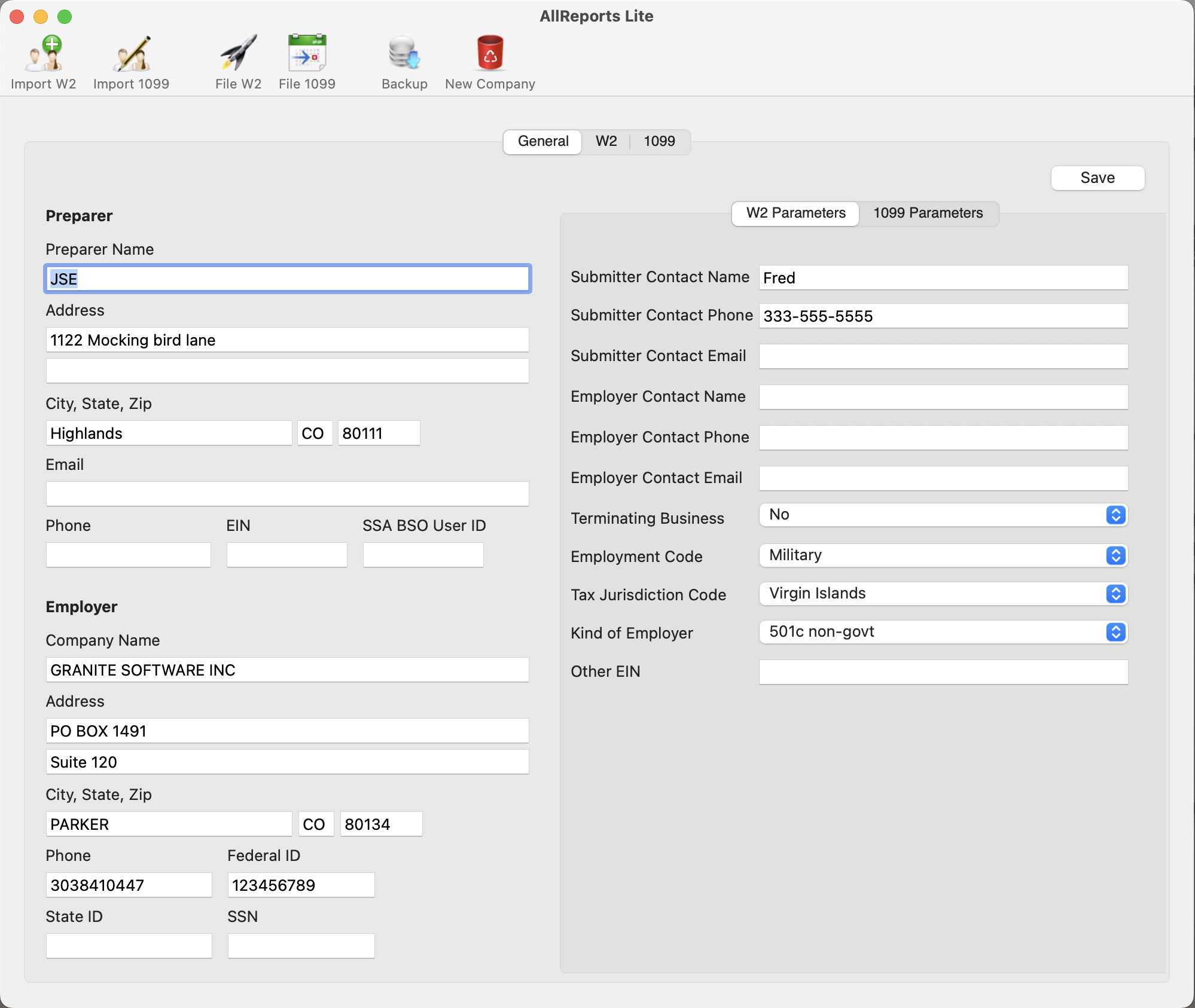

AllReports Lite provides electronic filing for W2s and 1099s just like AllReports. However, unlike AllReports, AllReports Lite will have the ability to load CSV files and enter data manually. Your W2 and 1099 data can then be easily filed electronically. An option is available to save the data that was created for future use.

Due to the filing changes last year, we wanted to provide a new, lower cost product, for companies that don’t use QuickBooks and still need to electronic file their W2s and 1099s. Download it today!

We have updated the interface of PitiCalc 2 (Principal Interest Taxes Insurance Calculator) to make it easier to navigate and use.

In addition to great software, we also offer the follow services: